Construction companies represent a large segment of companies working in the market, whether in Egypt or the Arab world, as a result of the urban sprawl in the new cities, there are thousands of construction companies that carry out construction work and as there is no activity without accounts related to it, construction accounting it had to require more attention.

Construction Accounting Definition

Construction accounting is defined as one of the branches of cost accounting related to estimating project costs, starting from awarding a bid (the project) until the project closure and handover, and for construction accounting, a set of stages that the project must go through, starting from buying the bid requirements and specifications until the project closure and handover but before starting to explain the stages the project goes through, a group of terminologies/ parties related to the project during its different stages must first be identified.

Project Parties

1- Client: means the project owner, which invites to bid and assigns the project to the general contractor.

2- General Contractor: means the construction company that implements the project and is responsible to the client (the owner).

3- Sub-contractor: it is a smaller construction company (category) to which the general contractor is assigned to implementing some of the project items and does not have the responsibility to the owner, but is responsible to the general contractor only.

4- Bid requirements and specifications: it is a booklet that contains all the technical and financial conditions, bill of quantities, and technical plans for the project, and the client submits it in conjunction with inviting tender to define the construction companies wishing to enter into the project with the project details.

5- Bid Security: it is an amount paid as a guarantee by the construction company wishing to submit financial and technical offers before attending the bids opening session and it is within of 1to 2% of the value of the process, it may be paid in cash or a bank guarantee letter, and the bid security to companies that did not award the bid will be refunded.

6- Performance Security: it is an amount that is held as a guarantee by the general contractor (the construction company that executes the project) and it is often within 5% of the project value and is called a performance bond.

7- Retention: it is an amount that is held from the general contractor payment certificates as a guarantee, is often within 5%, and will get back as soon as the preliminary handover of the project.

8- Advance Payment Bond: it is a percentage of the contract that the "owner" client pays to the general contractor in advance before the start of the project and once the preliminary handover of the site to provide the necessary liquidity to the general contractor to implement the project provided that these advance payments are deducted from the general contractor payment certificates.

9- Progress Billing: it is a document that includes quantities and prices of the executed items according to the contract concluded, it is considered as an invoice provided by the general contractor to the client to pay his dues.

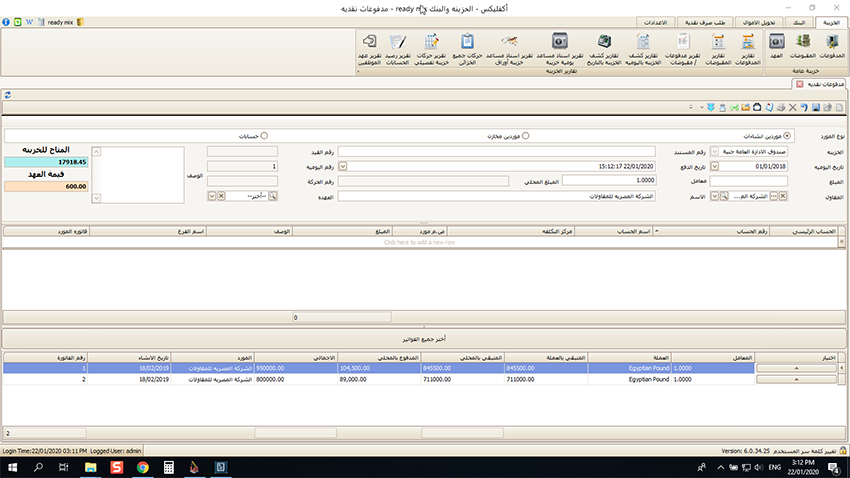

A screen showing the project parties in AccFlex constructions software

After identifying the most important parties and terminologies that characterize construction companies from others, we now review the phases of construction costs

First, inviting tender/bid stage

The client (the owner) makes a tender for the project implementation and submit the bid requirements and specifications for buying and determines the value of the bid security to attend the tender, then the construction companies buying the bid requirements and specifications and pay the value of the bid security in cash or a letter of guarantee and submit technical and financial offers for the project implementation and the client determines the technical and financial bids opening date for construction companies, and then he makes a comparison between the offers submitted by the construction companies by choosing the construction company that has the lowest price and meets all the technical requirements of the "general contractor".

Second, Project Implementation

Once the client selects the general contractor (the contracting company assigned to the project implementation), the general contractor receives the project under a preliminary delivery note for the site and then starts the work, and here the costs of the contractor are divided into

How to calculate the construction costs

A- Project Costs:

Which are any expenses that are incurred the project to earn the revenue and is divided into

1- Labor

Whether it is day labor, they are outsourcing in the project or the company's labor, as well as the wages of project workers such as site engineers, administrative staff, technicians, drivers working on the site, and others.

2- Materials

Means all materials that are purchased for project implementation as construction materials (sand- cement- gravel- brick- carpentry materials plumbing materials- electricity materials etc.).

3- Overhead

These are the equipment rental expense, transportation expenses to the site, security expenses of the site, utilities expense of the site, the subcontractor costs and general and administrative expenses... and others. Some expenses can be explained as follows

-Subcontractors: The general contractor shall outsourcing some construction companies specialized in one of the project items (marble and ceramic works), for example, the subcontractor will implement this item, and the general contractor shall pay the subcontractor according to the contract concluded between them.

- General & Administrative Expenses: These are the expenses related to the company's management of the staff and workers’ salaries, and vehicle expenses, depreciation of assets and rent of the administrative office and utilities expense, etc., which incurred by the company to the functions of management, supervision, and control of the project.

B- Project Revenue:

The general contractor during the project implementation shall survey the executed works and then make a payment certificate of these works, the executed quantities including the previous quantities "if there were previous quantities" and calculates the prices of these quantities at the price agreed upon with the client according to the contract signed between them and issued to the customer who pays the payment certificate after a deduction (advance payment- retention- social insurance- withholding tax- other deductions).

A figure showing a General Contractor's Payment Certificate

|

Arab Organization for Industrialization |

|

|

Certificate Number: 3 |

Project Title: Construction a building for the Organization in New Administrative Capital |

|

General Contractor: AL-Fath Construction Company |

|

|

Date: From 1/1/2020 To 31/12/2020 |

|

Description of Work |

Unit |

Quantities |

Unit Rate (EGP) |

Meritorious Work |

Amount (EGP) |

||

|

Previous |

Current |

Cumulative |

|||||

|

1- In square meter, construction work of reinforced concrete building 1 |

m2 |

1500 |

2000 |

3,500.00 |

100 |

90% |

315,000.00 |

|

2- In square meter, plastering works of building 1 |

m2 |

300 |

250 |

550.00 |

150 |

90% |

74,250.00 |

|

3- In the linear meter, the work of drilling bases and tie beams |

LM |

500 |

370 |

870.00 |

300 |

90% |

234,900.00 |

|

Total Gross Certified |

624,150.00 |

||||||

|

Retention Deduction (5%) |

31,207.5 |

||||||

|

Advance payment deduction (10%) |

62,415.00 |

||||||

|

Deduction of social insurance for the executed works (3.6 %) |

22,469.4 |

||||||

|

Withholding Tax Deduction (1%) |

6,241.5 |

||||||

|

Net payment certificate after deductions |

501,817.00 |

||||||

After the general contractor has fully implemented the project, issuing the final certificate to the client and then begins to get back the retained amounts as a guarantee, whether it is the retention that get back once the preliminary handover of the project, as well as the performance bond, that get back after the project close-out and handover.

The construction accountant has a significant role in calculating the construction companies’ costs, which can be mentioned as follows

Duties and Responsibilities of a Construction Accountant

1- Review and recording the customer payment certificates

The accountant reviews the payment certificate in terms of quantity surveyor with previous payment certificates, as well as reviewing prices with the terms of the contract, reviewing customer discounts according to the agreed proportions, recording the payment certificate accounting, reviewing the customer’s payment of the net payment certificate due and registering the payment of the payment certificate by recording the customer’s payments and providing the taxation of the payment certificate to the Tax Authority.

2- Reviewing and recording the subcontractors payment certificates

The accountant reviews the payment certificates in terms of quantity surveyor with the previous payment certificates, as well as reviewing prices with the terms of the contract, as well as ensuring that the retention and all dedications are deducted on the subcontractor, making sure that the net payment certificate is paid to the subcontractor, registering the paid of payments to the subcontractor, as well as providing the taxes due to the Tax Authority.

3- Recording all project costs

One of the most important duties and responsibilities of a construction accountant is to calculate the project costs as a cost center by calculating all project expenses, whether they are labor cost, engineers or administrative on-site, as well as calculating all purchases of materials for the project as well as all expenses, whether direct or indirect, to ensure that all costs related to the site are calculated.

4- Reviewing petty cash of the project

The petty cash is considered for site officers as the site treasury, which is paid to all emergency expenses that do not incur more time to pay, so the accountant reviews the paid payment for the petty cash of the project and also settles this petty cash by recording all the expenses paid from the petty cash.

5- Allocating general and administrative expenses to the project

Failure to allocate general and administrative expenses to cost centers properly may cause losses to the company and consequently record all general and administrative expenses such as bank expenses, financing expenses, wages, salaries, headquarters rent, and utility expenses, as well as the depreciation of fixed assets and allocating each project by its proportion making the project costs as accurately as possible and thus reducing the chances of losses to the company.

Accounting Software for Construction Businesses

There is no doubt that modern technology, especially construction accounting software, has had a significant role in creating a breakthrough in construction accounting management in construction accounting software that makes the company operate as one unit and makes linkage and integration between all departments in a way that affects providing all departments with the information necessary to decision-making and we can mention the most important the advantages of construction accounting software are as follows

The most important features of construction accounting software

Many advantages can be achieved by using one of construction accounting software, including:

1- Linking between sites and company departments:

One of the most important requirements for completing work within the construction company is the availability of information between the site and the company’s departments if the site needs any of the materials needed for building and construction work, inquiring about the availability of materials in the warehouse or a purchase requisition the materials from the procurement department or request a petty cash to the site’s treasury from the finance department so construction accounting software makes the company operates as one unit and then provides each department with the necessary reports to complete its work.

2- Calculating construction costs easily and accurately

In the presence of accurate information about the site, with the presence of fingerprint time & attendance devices for labor and linking them to construction accounting software, the human resources department can easily calculate the wages of workers and staff on-site, as well as issuing the subcontractor's payment certificates to construction accounting software that is easy to review and paid as quickly and as accurately as possible, as well as linking warehouses with the site make it easier to know the issue materials and then accurately calculate site costs, and as well as for all of the company's departments.

3- Calculating payment certificates easily and accurately

Linking between the site and the technical office department through construction accounting software makes it easy to see the quantities that are surveyed and reviewed and therefore the accuracy of making payment certificates.

4- Customers and subcontractors account management:

Through cost accounting software, it is easy to record and review customer balances and review incoming payments in customer payment certificates, as well as review paid payments to subcontractors in subcontractors payment certificates implemented in the project.

5- Asset management of the company:

The assets are considered to be the backbone of the construction companies, as they are the equipment, tools, and vehicles necessary for the project implementation, to calculate the costs of these assets accurately, each line item of the expenses related to these assets must be allocated to cost center and monitor the work hours of each asset and record it to its cost center, other methods that have made it possible to calculate the costs of assets, and that can only be achieved using cost accounting software.

6- The accuracy of calculating general and administrative expenses:

A construction company cannot operate without a project management administrative structure, as there are many general and administrative expenses such as depreciation expenses of assets owned by the construction company and other expenses that are difficult to calculate accurately except by using cost accounting software, which allocates general and administrative expenses to each site, making the project costs the most accurate.

Then we find that the use of construction accounting software facilitates the construction accounting management, as it calculates the costs as accurately as possible, and therefore the cost of acquisition for such software is in no way equal to the profits resulting from the cost savings that are achieved by the acquisition of cost accounting software, and the following are we will show a leading example for the best construction accounting software.

AccFlex Constructions Software Features

There are a set of features that are characteristic of AccFlex constructions software, which can be mentioned as follows

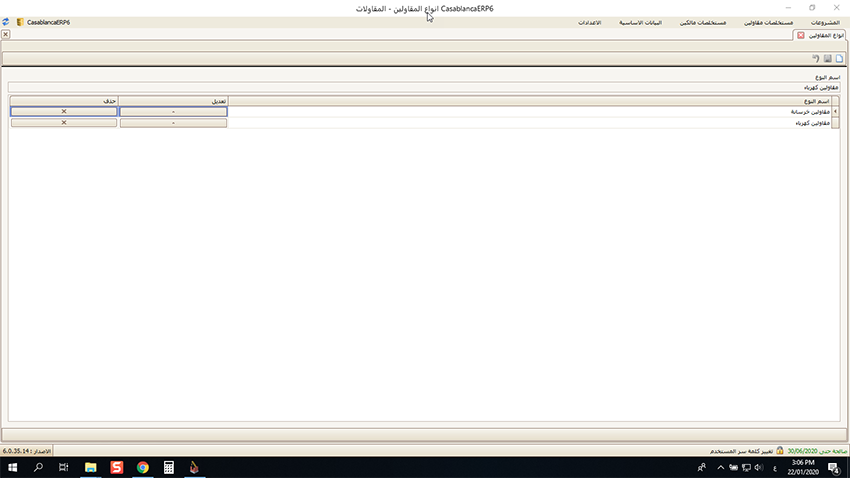

1-The remarkable customization of the parties in the construction project

AccFlex constructions software is characterized by the remarkable organization and customization of AccFlex constructions software screens, as there is a screen for owners and a screen for subcontractors, as well as a project management screen and a screen for preparing payment certificates in addition to reporting screens, which makes it easy to deal with the software and the impossibility of occurrence of errors.

2- The feature of selecting deductions and additions

AccFlex constructions software is characterized by the ability to define deductions (advance payment- taxes- retention...) that are deducted from the subcontractor or for the owner, as well as the additions through which the value-added tax (VAT) is added to work items from the configuration/settings screen to facilitate making the payment certificate automatically without the need to enter these deductions or additions manually.

3- Dividing the work items by contract

AccFlex constructions software is characterized by having a screen to link each contractor to his works, so the items can be divided as in the contract and link each sub-contractor to his works.

4- Linking the payments screen to the subcontractors accounts

AccFlex constructions software is characterized by having a screen to link all payments paid to the contractor and the progress billings. When paid, the payment certificate that we want to pay is selected, making it impossible to repeat the payment or the wrong payment occurs, as well as linking the payment to the receipt number and the certificate number.

Add a comment